Amid growing economic uncertainty, the American dream of homeownership might seem nearly impossible to achieve—particularly for families who are seeking to buy a property in one of the nation’s least affordable states.

Now, a state-by-state affordability analysis carried out by Realtor.com® economists is revealing the true cost of homeownership for the average family of four, detailing exactly how high their annual income needs to be in order to afford a property that is spacious enough to accommodate two adults and two kids.

The data reveals that, in nearly half of the states across the U.S., the typical four-person family does not earn enough to keep up with monthly mortgage payments on a median-priced three-bedroom home.

Hawaii tops the list of the priciest states for a family with two parents and two children that wants to buy a home, with the median price for a three-bedroom home in the state ($796,946) costing almost six times the median income for a family of four ($133,656).

The minimum recommended income to purchase a home with that eye-popping price tag is over $229,000—about 41% higher than the state’s median four-person household income.

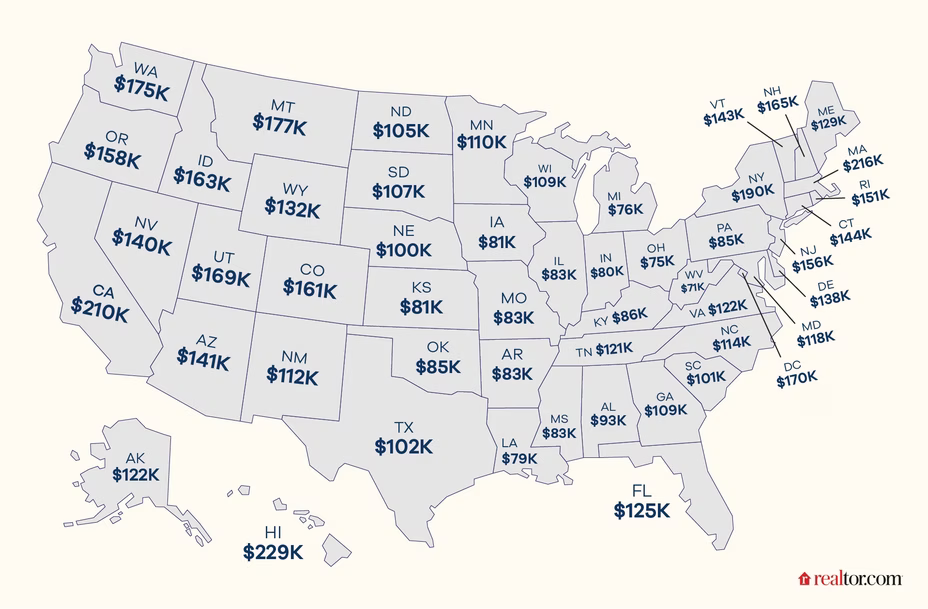

This map shows how much a family of four in every state has to earn to afford a home.

But Hawaii is not alone in its lack of affordability. Far from it.

California is not far behind the Aloha State when it comes to affordability, or lack thereof. There, the minimum recommended income to buy a median-priced three-bedroom home is $209,000.

The trouble is, the median income in the Golden State for a four-person household is $128,533, or 38.7% lower than the recommended income.

These figures factor in a rate of 6.65% on a 30-year fixed mortgage, property taxes, and insurance, and assume a 10% down payment. It’s important to note that homeowners who spend more than 30% of their gross income on housing are typically considered cost-burdened.

“Hawaii and California are among the nation’s most expensive states. Even though the typical four-person family income in these states is relatively high, it pales in comparison to home prices,” says Realtor.com senior economic research analyst Hannah Jones.

From Big Sky Country to the Empire State

According to Realtor.com data, Montana is the third least affordable state for a typical family of four wishing to buy a home without ending up in the red.

The median household income in the Big Sky state is $111,516, which is more than 36% below the recommend income of $176,513 needed to afford a median home priced at $613,375.

Neighboring Idaho follows closely behind, with the affordability gap between the minimum recommended income to purchase a median-priced home at $566,950 and the median four-person household income reaching a sizeable 34.8%.

Perhaps surprisingly, the Western Gem State is actually less affordable than the notoriously expensive Empire State when it comes to a family’s ability to buy a home.

In New York, the median three-bedroom home has a median price of $659,974, calling for a minimum income of $189,923, which is about 30% higher than the actual median household income of $131,389.

For comparison, nationally, the typical four-person household brings in about 4% more in annual income, at $123,617, than the recommended amount to afford a median-priced three-bedroom home of $412,000.

Overall, in 35 of the 50 states and the District of Columbia, a family of four needs to pull in six figures to buy a home.

The Midwest leads in homebuying affordability

For families hoping to purchase a home without breaking the bank, there are still plenty of good opportunities out there, if they know where to look.

As far as regions go, the Midwest dominates in the affordability department.

Illinois, Michigan, and Ohio boast median four-person family incomes that sit between 49.8% and 51.9% higher than the minimum recommended income to buy a property.

For example, in Ohio, a typical family of four has an annual income of $113,453, which is significantly more than the recommended $74,000 needed to afford a median-priced $259,450 home, making the state the nation’s most affordable in this specific category.

In Michigan, Illinois, Iowa, and Pennsylvania, four-member families earn between 49.9% and 47.4% more than the income that is recommended to afford a median-price three-bedroom home ranging from $265,350 to $296,750.

“Affordable housing in these states means that families can spend a bit more on other necessities or can save more, taking some pressure off the all-too-familiar budget dance,” says Jones.

10 states where families need the highest incomes to buy a home

1. Hawaii

Median home price: $796,947

Median household income recommended for buying a home: $229,341

2. California

Median home price: $728,500

Median household income recommended for buying a home: $209,643

Palm Springs, CA

3. Montana

Median home price: $111,516

Median household income recommended for buying a home: $176,513

4. Idaho

Median home price: $566,950

Median household income recommended for buying a home: $163,153

Emmett, ID

5. New York

Median home price: $659,974

Median household income recommended for buying a home: $189,923

6. Utah

Median home price: $586,200

Median household income recommended for buying a home: $168,693

West Jordan, UT

7. Nevada

Median home price: $485,598

Median household income recommended for buying a home: $139,742

8. New Mexico

Median home price: $389,700

Median household income recommended for buying a home: $112,146

Rio Rancho, NM

9. Massachusetts

Median home price: $749,950

Median household income recommended for buying a home: $215,816

10. Oregon

Median home price: $550,000

Median household income recommended for buying a home: $158,276

Grants Pass, OR

10 states where families with the lowest incomes can buy a home

1. Ohio

Median home price: $259,450

Median household income recommended for buying a home: $74,663

2. Michigan

Median home price: $265,350

Median household income recommended for buying a home: $76,361

Mt Pleasant, MI

3. Illinois

Median home price: $289,950

Median household income recommended for buying a home: $83,440

4. Iowa

Median home price: $279,950

Median household income recommended for buying a home: $80,562

Burlington, IA

5. Pennsylvania

Median home price: $296,750

Median household income recommended for buying a home: $85,397

6. Kansas

Median home price: $280,298

Median household income recommended for buying a home: $80,662

Perry, KS

7. Indiana

Median home price: $279,450

Median household income recommended for buying a home: $80,418

8. Minnesota

Median home price: $380,948

Median household income recommended for buying a home: $109,627

Lea, MN

9. Maryland

Median home price: $408,323

Median household income recommended for buying a home: $117,505

10. Missouri

Median home price: $289,000

Median household income recommended for buying a home: $83,167

St Louis, MO