Overview

Historically, homeownership has been considered a cornerstone of the American Dream. Today, about 65% of American households own a home, and roughly 5% own more than one. Homeowners view these residences as not only a place to live, but also a path to building substantial wealth.

Centuries ago, homeownership became more common as political systems evolved to allow individuals, rather than governments like monarchies, to own land. In the US, the number of homeowners increased as mortgages became more accessible: Roughly 74% of today’s US homeowners used a mortgage to finance their home.

Real estate makes up roughly half of the typical American homeowner’s household net worth. The financial benefits of homeownership include diversifying one’s financial portfolio while protecting it from inflation, building equity, and more.

The numerous costs associated with homeownership are often cited in the ongoing debate over whether renting or owning makes more financial sense, including homeowners insurance, property taxes, and budgeting for maintenance and repairs.

Mortgages evolved from exclusive agreements for the wealthy into a key part of homeownership today

The word “mortgage” comes from medieval French, meaning “death contract”—but the modern American mortgage has a more recent and complicated history. This explainer looks at how mortgages evolved from exclusive agreements for the wealthy into a key part of homeownership today, including the impacts of New Deal policies, redlining, and the Fair Housing Act.

57% of future homebuyers plan to put down less than the recommended 20% on a house

Historically, experts have recommended buyers put down 20% on a house when buying. But due to rising housing costs and the cost of living, this goal is unattainable for many buyers.

About 88% of all homebuyers feel their home is a good investment

According to data from 2022, 50% of homeowners felt their home was a better investment than stocks. The financial benefits of homeownership are significant: From avoiding rising rents to tax advantages, this interactive article outlines several.

For much of human history, homeownership was primarily associated with the elite

Before the Industrial Revolution, early mortgages were rather exclusive loans given only to nobility. But as more people gained more wealth through the Industrial Revolution, banks began to take on “higher-risk” loans to everyday people.

Hawaiians must earn higher annual salaries than anywhere else in the country—roughly $229K—to purchase a typical home

This map of the US shows the annual income required to purchase a typical three-bedroom home in each state. This is based on a 10% down payment, a 6.65% interest rate on a 30-year fixed mortgage, and a 30% income-to-housing cost threshold, including taxes and insurance, according to recent data from Realtor.com. According to the data, Hawaii is the state where you’d need the highest yearly income.

Experts recommend putting aside between 1% and 4% of the home’s value for maintenance

Experts say homeowners should consider the home’s age and condition, and its location’s climate, when deciding exactly how much to put aside for repairs and maintenance. They also recommend setting aside more money for those who expect to hire others for home repairs rather than doing it themselves.

US homeownership rates declined from the start of the Great Recession through 2016

In 2004, the US homeownership rate was 69%. When the bubble popped in 2007, due to a variety of factors (including the prevalence of subprime mortgages) the Great Recession began. Foreclosures increased, as did the ratio of renters to homeowners. In 2016, the homeownership rate was at roughly 63.4%.

The average wealth gap between homeowners and renters was more than $1.3M in 2022

In 2022, the median wealth gap between homeowners and renters was closer to $390K—a significant divide. Over the past three decades or so, the median wealth gap between homeowners and renters increased by 70%, while the average wealth gap increased by more than 250%.

A deed is a legal document that shows change of homeownership during a sale

A deed differs from a title, which is the actual right of ownership to a property, and a concept rather than a physical document. These days, many deeds are online rather than physical pieces of paper kept in a home.

A ‘rent vs. buy’ financial calculator

The New York Times built a continuously updated financial calculator to help potential homebuyers figure out which makes more sense given their individual situation: buying or renting a home. It takes into account how long someone plans to own the home for, mortgage rates, and more. Here is a similar model from NerdWallet – https://www.nerdwallet.com/mortgages/calculators/rent-vs-buy-calculator

Singapore grew its homeownership rate from 27% to 90% in less than 30 years

That progress stemmed from Singapore’s founding prime minister, Lee Kuan Yew. He used a three-pronged approach to the homeownership solution: create affordable housing; make financing readily available to people of all walks of life; and help people gather down payments.

It takes an average of 14 days of work to afford a monthly mortgage in the US

This map of the US shows the number of eight-hour workdays it would take to afford a monthly mortgage payment in each state. Specifically, the calculations are based on median hourly wages in each state, as well as a 30-year mortgage, 5.8% mortgage rate, and a 6% down payment.

Simple home improvements like proper insulation can reduce winter energy bills

To save money in the colder months, some experts recommend washing your clothes in cold water, using your dishwasher instead of washing dishes by hand, and more. This article lists even more winter money-saving tips.

Refinancing a mortgage is when a homeowner exchanges their current loan for a new one

Homeowners typically refinance to secure a lower interest rate and potentially a new loan term length. Debt owed on mortgages made up about 70% of US consumer debt as of 2025.

Buyers used to borrow money from people within their communities to purchase property

Historically, borrowing money from other people to purchase property was common until private financing companies—primarily building and loan associations—stepped in to offer mortgages to buyers.

The average monthly mortgage payment in the US costs 38% more than monthly rent

A recent study showed that the price gap between renting and buying grew in 38 major US metro areas since last year. The metro areas with the smallest price gaps between renting and buying include Detroit, Philadelphia, and Cleveland.

US homes have been shrinking in recent years

Specifically, the median square footage of new single-family homes in the US has decreased in each of the past several years. In 2015, the typical new-construction home was about 2,467 square feet—but by 2024, that number had shrunk to 2,146 square feet.

Surprising costs associated with homeownership include taxes and roof maintenance

Owning a home includes not just expected costs such as a mortgage, homeowners insurance, and landscaping, but also less-obvious expenses like property taxes, repairing and maintaining one’s roof and HVAC system, and HOA fees.

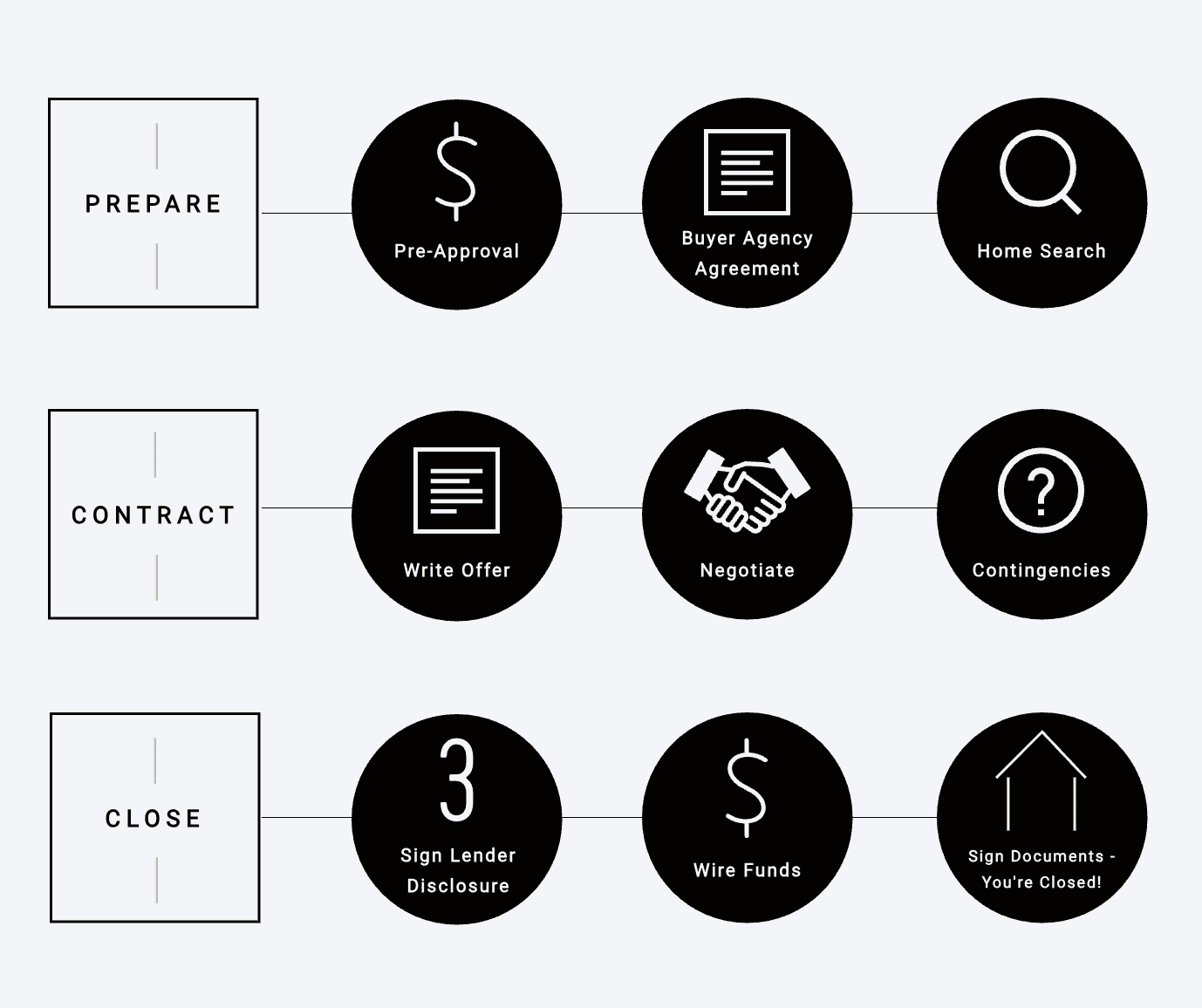

A guide to the homebuying process

From searching for the home itself to writing an offer letter to closing on the home, there are specific steps involved in becoming a homeowner. This checklist from a Tennessee real estate broker provides a visual outlining the basic steps of the process.